The recent economic struggles in mainland China have had world-wide implications. Stocks on Wall Street tumbled as Chinese industrial output retreated, and many ask “why?”. As their growth slows and factories lose business would not their prices drop and would that cost decrease not be reflected in lower prices for western consumers? What is happening and how should companies respond to the evolving situation? Doesn’t bad news for China’s economy mean good news for the US economy?

The recent economic struggles in mainland China have had world-wide implications. Stocks on Wall Street tumbled as Chinese industrial output retreated, and many ask “why?”. As their growth slows and factories lose business would not their prices drop and would that cost decrease not be reflected in lower prices for western consumers? What is happening and how should companies respond to the evolving situation? Doesn’t bad news for China’s economy mean good news for the US economy?

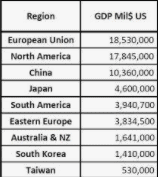

Well in a word, no. All world economies are interlocked and a lowering of any individual country will have adverse effects on the others – the larger the economy the larger the effect. So how do the world economies compare? China is number three with a bullet.

According to Robert Mittelstaedt at the Cary School of Business the shift away from being a source of cheap labor means China may be losing its place as the world’s go-to supplier of cheaply made components as it transitions away from manufacturing and exports. As worker salaries increase and a upwardly mobile middle class socks away discretionary income the Chinese domestic markets will grow rapidly. As their capacity is taken up internally the western consumers will be forced to look elsewhere for cheap sources and we are rapidly running out of options.

For the savvy American and European companies this country of 1.4 billion people could turn into trillions of dollars in potential sales. It is time that we looked at China as a customer and not as a vendor. Should we be tooling up in preparation for a flood of orders from the newly affluent Chinese?

For selective products the panache of luxury western goods makes this a lucrative market for famous name products like Harley Davidson motorcycles, Cessna aircraft, Mercedes Benz automobiles, and for consumables like McDonalds hamburgers. For high fashion items the future is less clear since China is already the world’s source for cheap knock-offs. Still, when traveling abroad the Chinese nouveau riche are gobbling up authentic Rolex wristwatches, Prada handbags, and Christian Dior shoes. How do your products stack up? Will you still be buying from the Chinese or selling to them?

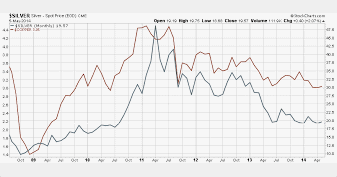

As the Chinese concentrate on their domestic market how does that change in direction affect manufacturing costs in the west? Historically the consumption of raw materials in China has been in support of demands in the west so we were not actually in a competitive market bidding up the cost of resources. However as the flow of processed goods changes to remain within China then their domestic consumption will be withdrawn from the world market, competitive bidding will ensue and prices will begin to rise. Bloomberg has published significantly on the volatile price issue. The condition is expected to improve during their weak economy (Reuters Jan 2016: “Copper sinks to lowest since 2009, losses reflect China gloom”) and worsen as their economy improves.

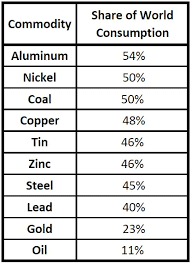

How much are the Chinese using today? This table is a list of some major raw materials currently being consumed in China. Note that China contains 20% of the earth’s population but consumes nearly 50% of many natural resources. As their prosperity grows so will their demand, stretching the capabilities of the world’s processing plants and the ability of the environment to withstand the onslaught without dramatically increased implementation of expensive controls that will drive up prices.

Energy-related issues equal raw minerals in importance. In the west all processed metals including steel are heavy users of electricity whereas in China steel relies on coal, mainly directly in blast furnaces but also indirectly in that 75% of China’s electricity comes from coal-burning power plants. Oil will become increasingly important in their market and the Chinese are already setting their stakes on the undersea resource of the South China Sea. By 2025 the Chinese overall consumption of energy is expected to exceed that in the US by nearly 50%.

In summary we see that the Chinese market is losing their competitive edge as a nation of exports and is evolving into a nation of consumers. This will hold sales opportunities for companies whose products convey status cachet and for companies willing to trade short term sales in exchange for technology licenses that will permit the domestic Chinese companies to fulfill the more technical products niches in the future. These conditions will hold purchasing perils for many feedstocks as production costs increase and availability decreases. The sometimes wild volatility that we have experienced during the previous 5 years is expected to continue and accurate predictions will become impossible.

To prepare for this scenario a company’s engineering and procurement staffs will need to work together during product development to design-in optional materials to take advantage of markets moving in a favorable direction and to mitigate movement in the other direction. If nickel becomes in tight supply and the availability of stainess steel becomes problematic, are you ready to move to powder coated carbon steel or anodized aluminum. If RoHS compliance eliminates lead and tin prices go through the roof, how will you compensate? Could a die casting be replaced by an injection molded part – and vice versa? The future will be replete with challenges and opportunities and now is the time to prepare for them.

Comments are closed