Author Archives: Robert Simon

-

Still considering off-shoring?

Leave a CommentChanging economics move contract assembly to North America

In which direction are the economies of electronic production pushing the choice of manufacturing location? What is the history of the situation and assumptions? And when is it time to re-evaluate those assumptions?

In the 1950’s and 60’s many US and other Western companies moved manufacturing to Japan, where labor was cheap and factories were being rebuilt using enormous investments from the US and our allies. The Japanese quality was initially poor but rapidly improved and Japan became a real economic powerhouse. Along with this increased sophistication came increased cost, and western companies began the move to Korea where again, investment poured in after the Korean ceasefire.

The Koreans started out mindful of the Japanese experience and emphasized quality early on. This made Korea a better source for electronic assemblies but their smaller population (25 million Koreans vs 95 million Japanese in 1960) caused rapidly increasing labor costs. Next stop – Taiwan.

The very western-leaning government in Taipei combined with a large educated class in the workforce made Taiwan an easy fit for American companies. This writer’s personal experience working there was much like Bayonne or Bayport: the Taiwanese had a funny accent but followed the same Yankee Doodle drummer leading to escalating sophistication, profits, and cost. However by the turn of the 21st century even Taiwanese companies read the kanji on the wall and began to open subsidiaries in mainland China where land, building, and labor were cheap and often subsidized.

These lower costs coupled with the loosening governmental control in mainland China made for fertile ground where companies could expect to grow quickly and to dramatically cut costs. There was a scarcity of university-educated engineers and experienced managers, so most startups were not Chinese based but rather staffed and managed by Japanese, Koreans, and the entrepreneurial Taiwanese.

Part of the competitive nature of the Chinese model was based on low manufacturing costs, where human labor was usually more cost-effective than automation. This meant start-up capital was low but also meant that quality was more difficult to control. When output varied because of the human interface, the parts not-to-specification were simply culled out during inspection and discarded or sometimes just ignored as being “close enough”.

As the world market demanded increased quality the producers in China invested in more automation and higher caliber staff with increased training and product flow responsibility. Inevitably costs began an upward climb. The price of fuel increased globally and with it the cost to ship to their customers half-way around the globe, so the competitive nature of China began to decrease.

China has historically undervalued their currency, promoted low labor cost, and subsidized raw materials and energy costs in an effort to develop a mushrooming industrial base. This has been effective and even in the face of rising costs China’s role in the world economy has grown at the expense of other nations. There seemed to be no stopping their growth.

The international economic playing field has never been level as each country erected duties on inexpensive imports that ate away at the ability of their domestic manufacturers to grow and develop. A second tool used to give home-grown industries a boost has been subsidies (often farm products) and government sweetheart contracts (the aerospace industry). Any effort by an industrialized country to harmonize trade with developing countries has received resistance and threats of suits in international courts. The “balance of trade” has been a key measurement, contrasting imports from and exports to specific trading partners. However even when the numbers pointed to a disparity there was little a country could do to level the playing field. Then came the tariffs.

Tariffs are a double-edged sword, protecting targeted industries while adding to the cost of living for the population in general. The goal is usually to make them last long enough to spur domestic protection and short enough to avoid a dramatic increase in the cost of living or an outright shortage of certain goods.

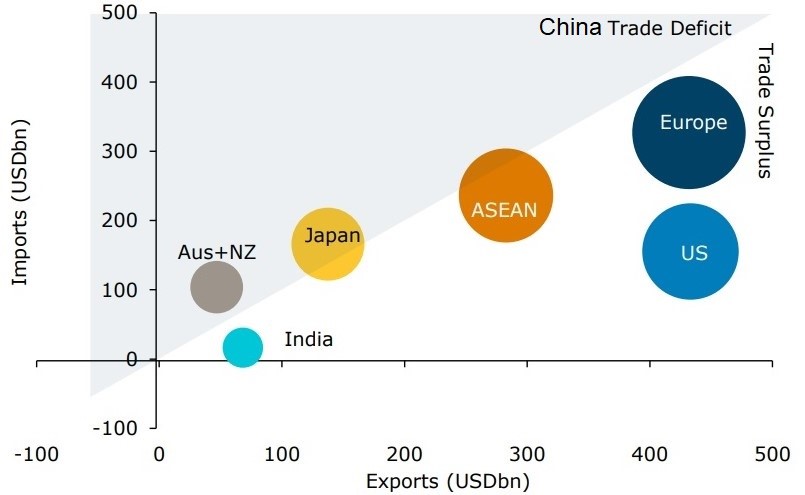

China’s largest export market is the US, and they export to the US five times the amount that they import from the US. The Chinese trade with the EU is more balanced but still far in Chinese favor.

The Chinese economic growth plan is based on maintaining and even increasing this advantage, but that could hold true only if their trading partners were willing to accept the status quo at the expense of their domestic industries. Tariffs are one way to force a short-term rectification of the imbalance.

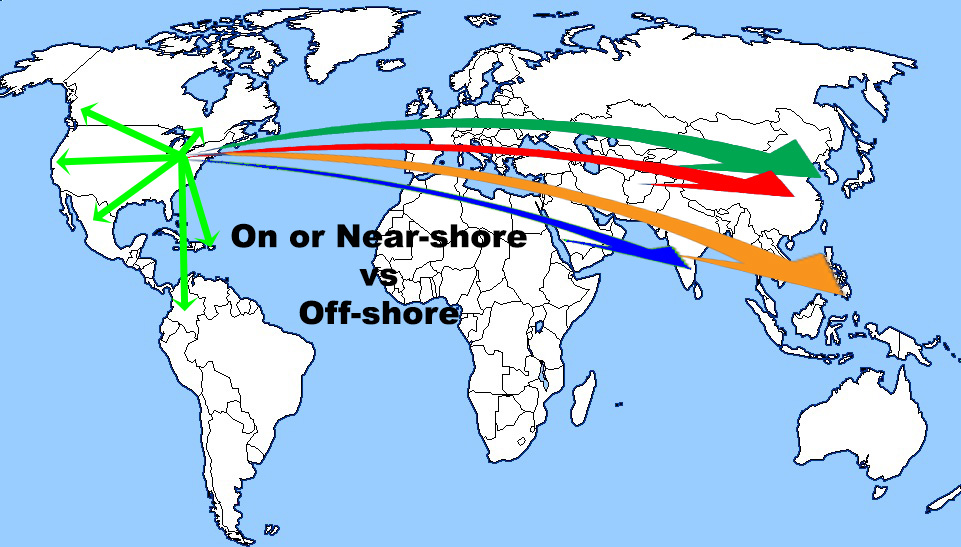

The US has imposed punitive tariffs on a wide range of raw materials and finished goods from simple metal extrusions to sophisticated electronics. Ten per cent has grown to 25%, and $50 billion in goods to $300 billion in goods, nearly every product imported. The short-term effect is already being seen with American companies sourcing to other low-cost regions or moving production back to the US. As China struggles with lower output their cost to produce is rising, reducing their cost advantage against other countries. Headlines are already reporting that China may have missed its opportunity to grow into an economic giant. Bad for them does not necessarily mean good for us, but it does mean that American companies have decisions to make in the next few years. Electronics assembly production is a prime example of an industry in transition. Will we go to other LCR and repeat this scenario or will we re-shore?

The North American sources for contract assembly, having watched their markets shrinking away, are seeing a ray of hope: they could compete on the world stage and indeed win the economic struggle not only against the historical competitors but also against any of the new smaller (Vietnam, Thailand) and potentially larger (Brazil, India) low cost regions.

Let us review the actual history and trends in China, realize what has happened to the cost savings that were envisioned just a few years ago, and take heed

The Supporting Data:

Seven years ago the push to offshore contract assembly was at its peak, and with good reason. US demand was up and volumes were increasing. US labor and raw material costs had risen dramatically. Cheap knockoffs from Chinese companies were flooding the market. To compete the US companies chose to join them, not fight them, and began moving first simple subassemblies and then more complete products to LCRs (low cost regions) like China and Vietnam.

We, the American consumer, cannot blame the US off-shoring companies. We wanted more and we wanted it cheaper. We accepted lower quality because ours was a throw-away society – use it for a while and when it breaks just buy a cheap replacement. We went from buying just the most basic components off-shore to buying completed goods, all made in the world’s LCR.

Today however that tide is turning. The change in currency exchange alone has made this a different world. The US dollars just do not buy as much off-shore as it used to.

The environmental mantra of “reduce, reuse, recycle” has taken hold. Americans are willing to pay a bit more for things of a higher quality that might last longer. Would we pay double? Probably not. So where is that tipping point and how close to it are we? When should producers in this hemisphere investigate on-shore contract assembly? Let’s look first at recent changes in cost in the Pacific Rim.

- Chinese labor costs have doubled and are expected to rise another 50% in 4-5 years.

- Chinese currency is more expensive: it had been over 8¥/$, and is now <7¥/$.

- The cost of shipping products has increased, some rates by 43%, others by more.

If you left our shores for contract assembly in the Far East, and you then saved one-half of your production cost, how much of that savings remains today? 15%? 10%? Less??? Even just 10% might be a reason to let the business remain there because after all, why incur an avoidable cost increase? Are there issues that must be considered in addition? The answers might be in the less obvious areas.

Doing business around the world has obvious hurdles, like language. There are also less obvious obstacles like business mindset and ethics. We in the West have standards that differ even on a single continent. We should not be surprised to discover that there is a greater difference between cultures with less history in common. That is not to say that one is better than the other, only that they are different and must be taken into account in negotiations and daily business transactions.

What are other practical issues that impact an OEM’s business when considering off-vs-on shoring?

- Should you invest in an overseas (Vietnam, India, Singapore) manufacturing scenario today if there are major aspects over which you have limited control, and there are forecasts of increasing economic pressure?

- The 10 to 12 hour time difference: how easy is it to have a phone or video conference if one group is just arising while the other is getting ready for dinner? Is everyone really at the top of his game?

- The 24 hour trip to have an on-site round table discussion. How many of your staff could you spare at the same time so as to make the meeting truly productive? And what happens back home while they are gone – it is still that 12 hour phone tag lag.

- What is the background, ability, and availability of the LCR staff? Do they have the skillset that you are used to encountering? Do they smile and nod because they agree or because they do not understand?

- Are your quality standards something that they are just willing to accept or do they wholeheartedly embrace the concept? Are they committed to protect the product quality and hence the good name of their clients or would they walk away from a situation and just move on to another client from a different industry or different country. After all, their name is shielded from notoriety by secrecy agreements.

- And speaking of secrecy, how is your intellectual property protected? Agreements for non-disclosure are easy to sign but difficult to enforce when the parties are separated by 8,000 miles, different legal systems, and centuries of tradition.

Quantifying these non-monetary aspects is difficult but we know they exist. When do they, added to the direct cost, warrant moving your contract assembly back to North America?

This question could be answered with the use of a super computer and the services of many an expensive consultant. Or you could bid your next job here and there, compare the economic results, factor in the ease of dealing locally, and make your first on-shore placement. You will not be the first in North America to make that change and you will certainly not be the last. If you would like a helping hand as you make your decision, just ask USTEK Incorporated – we have the experience!

-

Don’t Stock-up on Inventory!

Leave a CommentDoes your company’s stocking system look like your grandmother’s?

One hundred years ago our great grandmothers stocked up for the winter by canning, pickling, and drying foods to last until spring. Today we preserve mostly as a hobby and buy groceries and such only when we need them. Why lay out the cash and fill up a pantry with items you will not need for months? Instead buy what you need just in time to use it!

Currently we are faced with the identical options in the electronics industry: buy large quantities for lower prices and safety stock benefits, or order only what is required to meet the production schedule. The former ties up cash flow, fills floor space with unused goods, requires additional insurance, and mandates environmental controls. The latter requires attention to scheduling lead time and often a higher price.

How best to balance the advantages and disadvantages? Is there a source with all the benefits and none of the losses?

(I would not have written this if I did not already know the answer!)

Yes indeed; you could

- cut your inventory cash investment by 50%+,

- Repurpose your inventory space for manufacturing,

- reduce your burden,

- respond faster to your customers’ demands,

- and still save money.

At USTEK Inc. we calculate the customer’s price based on the annual volume. Then we build a portion of that estimate ( typically 3 to 4 months ) and hold it in our Ohio stock for kanban/just-in-time requirements. Releases received by 1 PM are shipped the same day. Examples of the savings:

A large 4-layer printed circuit board used in quantities of 100 pcs per run was priced at $18.22 each. When this went on our kanban stocking program the customer’s price dropped to $13.80. This saved the them 24% in piece price and 90% in inventory expense. A fabricated metal part had been quoted at $2.89 for a single 1500 piece order but dropped to only $1.22 for the 12k piece kanban release order. Piece price savings of 58% and an inventory decrease of 87%.

The cost reductions will vary with your component type and the volume – so send us your design files and specifications and we’ll get to work demonstrating your savings!

-

Beyond RoHS

Leave a Comment The RoHS requirement came into being as a way to remove potentially hazardous materials from coming into contact with people and from entering the world ecology through improper disposal. Beryllium (Be), cadmium (Cd), chromium (Cr), mercury (Hg), arsenic (As), and lead (Pb) are among the most common metals that bear discussion. They have not nearly the lethal level of polonium (Po) which is deadly at less than a billionth of a gram, but because of the amount produced every year their use and disposal needs to be controlled.

The RoHS requirement came into being as a way to remove potentially hazardous materials from coming into contact with people and from entering the world ecology through improper disposal. Beryllium (Be), cadmium (Cd), chromium (Cr), mercury (Hg), arsenic (As), and lead (Pb) are among the most common metals that bear discussion. They have not nearly the lethal level of polonium (Po) which is deadly at less than a billionth of a gram, but because of the amount produced every year their use and disposal needs to be controlled.We in the chemicals industry have dealt with these metals and a host of other materials. As their hazardous nature became evident we have worked to minimize their use. Asbestos served admirably as a heat insulator and a reinforcement for plastic and metal composites. When asbestosis was researched that mineral’s use was rapidly curtailed and protective measure were implemented in its few remaining applications.

During the 19th century arsenic was used as an embalming fluid which

subsequently polluted the ground and water supply near burial sites. This has now been replaced by formaldehyde (which has its own issues). The bright cadmium yellow in plastics have been replaced by organic azo compounds. Each time an issue was considered and proven, steps for amelioration were taken.

subsequently polluted the ground and water supply near burial sites. This has now been replaced by formaldehyde (which has its own issues). The bright cadmium yellow in plastics have been replaced by organic azo compounds. Each time an issue was considered and proven, steps for amelioration were taken.Closer to our industry, the lead in our solder-flowed printed circuit boards has been replaced by formulations high in tin (Sn) with small additions of copper (Cu) or silver (Ag). Formulations that meet the RoHS regulations are today so common as to be considered as the standard build, with lead-containing PCBs now a special order.

Still, with the widespread use of circuit boards at the end of their useful life we need to investigate methods of disposal that both reclaim the reusable constituents and minimize the toxic effects of the portion that must be discarded.

Many ecology-oriented investigations are European as is a paper written in Italy by Maria

Paola Luda at the Dipartimento di Chimica IFM dell’Università di Torino. That paper on recycling PCBs was published by Intech Open who makes available works of over 100,000 authors on-line in a searchable database.

Paola Luda at the Dipartimento di Chimica IFM dell’Università di Torino. That paper on recycling PCBs was published by Intech Open who makes available works of over 100,000 authors on-line in a searchable database.Awareness of our ecology is not strictly the pervue of tree-huggers. They demonstrate; we solve problems.

Attached here for your perusal is Luda’s paper.

-

Why Lead-free RoHS Circuit Board Assemblies?

Leave a CommentThe Restriction of Hazardous Substances (RoHS) directive 2002/95/EC began as a European movement to decrease the deposition into the environment of known carcinogens and to enhance the recyclability of mixed-material waste. The goal was to create a new generation of electrical products that are free of substances hazardous to health and the environment.

Initially all companies that manufacture, import or rebrand electronic equipment destined for sale in Europe were required to ensure their products comply with RoHS guidelines. Exemptions were granted when life could be put at risk including medical and military applications. Following on the heels of these restrictions and based on similar research, US regulations are now coming into effect.

RoHS focuses on six substances. Lead (solders), hexavalent chromium (anti-corrosion and colorant), cadmium (phosphor, colorant and battery), mercury (batteries), polybrominated biphenyls and polybrominated diphenyl ethers (both flame retardants).

Of universal concern to circuit board users is the lead content of HAL solder, solder paste, and wave solder. When the regulation first hit many companies prepared to run pure tin (Sn) at a higher than normal reflow temperature and so changed the board base composite to a high Tg (170°C-180°C) . This proved to be a costly fix and subsequent trials by manufacturing engineering showed that standard FR-4 performed adequately with the lead-free solders..

Solder alternatives have been studied by the EPA whose findings indicate that for lead-free solders, the tin/copper alternative had the lowest (best) scores. For solder pastes, bismuth/tin/silver had the lowest impact scores among the lead-free alternatives in every category except non-renewable resource consumption.

For both paste and bar solders, all of the lead-free solder alternatives had a better life cycle assessment of leachability score in toxicity categories than tin/lead solder. This is primarily due to the toxicity of lead, and the amount of lead that leaches from printed wiring board assemblies.

Recently the demand for RoHS components has grown so that in many industries that certification has become the norm. As the RoHS manufacturing lots increased in size the surcharge decreased. Today there is little if any cost penalty in meeting the RoHS compliance on both bare and reflowed PCBs.

Today the largest cost increase in running RoHS circuit boards is a solution without a problem – costly high Tg (170-180°C) substrates. Initially reflow ovens were cranked up to flow the lead-free solder paste and that caused warpage and other issues. However a couple years’ experience and a better heat profile gets the job done using the standard Tg 135°C. Costs have dropped back to SnPb solder days.

USTEK Inc. has worked closely with both contract manufacturing and OEM partners to ensure that RoHS compliance is achieved with maximum product performance and at the lowest possible cost. We are actively seeking additional client-partners. May we support your work in RoHS compliance?

-

“Boilerplate”

Leave a CommentBoilerplate is a good thing to have on the side of a steam locomotive but questionable in the engineering notes for a printed circuit board.

There are many options available to which most of us never give a second thought. The Gerber files contain the traces and outline but rarely the tolerances. Some common specifications are written on the 1-up print in the block. Others show up as notes on a panelization drawing. Many are consolidated in a formal spec sheet.

In general these selected choices work well, so why bother evaluating them for each and every new design? The answers are twofold: performance and price.

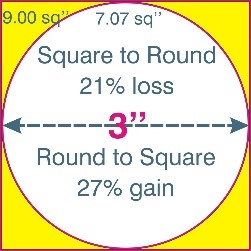

One of the most basic design criterium is the board shape. Round boards show up in instrument clusters and light fixtures. But lacking some peculiarity of the device we commonly choose right-angled boards, square rather than round.

One of the most basic design criterium is the board shape. Round boards show up in instrument clusters and light fixtures. But lacking some peculiarity of the device we commonly choose right-angled boards, square rather than round.That is with good reason as we want to get as much as possible into the minimum area to control board costs that are calculated on a $/SqIn basis. A round board yields 25% less than a square board, so square corners are better. Or are they always?

Consider handling loss with a square-cornered PCB, particularly a large heavy board. In shipping the forces of a carton tossed onto a truck are concentrated on a sharp corner often resulting in a split box or a damaged board. Within the assembly facility the corners are the weakest point on the board and are there too subject to damage. Better packaging and personnel training would help alleviate the damage but there are two other ways that are in the hands of the PCB designer.

The first method is to add two rails to all boards whether or not arrayed. Most processing equipment use fingers or a standard-sized holders to grip the board during stuffing and soldering but when not required we often decide against the wasted material and cost. For large boards we might be better served by including the rails.

A second method is simply to round the board corners. The area in the corners is usually not used for components, traces, fiducials or tooling holes and could easily be eliminated. The radius need not be great and 0.040” (1mm) to 0.250” might work quite well. If boards are in an array then a router plunge-cut would be necessary to maintain the ability to score the straight sides. This board was laid out square but a rounded corner would render only the small yellow areas unusable.

In some designs rounded corners are contraindicated. Many arrays of small boards are scored. Rounding each corner would necessitate routing instead and this would require both additional space and increased bare board processing time, yielding a higher board cost.

A second concern would be a final installation in which the boards are tiled, lined up side-by-side as in this diagram. Sharp right angles would make the mosaic design look seamless whereas rounded corners would display gaps at the intersections (yellow areas).

Rounded corners are not a solution applicable to all designs but one of the typical boilerplate design features that could bear a review before the board design is put into production.

-

Is Isola running scared?

Leave a CommentAlthough Isola had published the announcement quoted below, alluding to the termination of manufacturing FR406, they now seem to be backpedaling a bit and state that it is still available. Perhaps someone let the cat out of the bag a bit early???

Reports from PCB manufacturers continue to pour in stating in simple terms that FR406 is either extremely limited or completely unavailable. These PCB suppliers are recommending that design staffs change specifications to a KB material with Tg 170 or to the ShengYi equivalents. Those alternative products are readily available and typically as a lower cost.

And from the land of brass-balls, some Isola staff are threatening legal action for making the public aware of this situation. Makes one wonder about the viability of their entire organization.

================================================================

Originally published as “Prepare for demise of Isola FR406: ”

Important Notice from Isola:

The Printed Circuit Board Industry has been transitioning to RoHS PWB’s in accordance with the 2006 European directive. Part of this transition is the use of lead free solder in the assembly operation, these solders have up to 50oC higher reflow temperatures. By the end of 2016 most RoHS exemptions will have expired and PWB’s will have to survive the lead-free assembly process.

As a result Isola is discontinuing regular production of their FR406 laminate family; this material will still be available for an undetermined time, but at increased cost, increase material lead-time and with minimum order requirements.

Current specification:

CTE Z-axis Tg Td Dk Df FR406 3.5 170 300 3.93 0.0167 We are offering Isola 185HR as the primary replacement for FR406 to be used on new and existing designs. The 185HR laminate is a NEMA/ANSI grade FR-4 laminate and is even more tolerant of lead-free assembly operations than FR406. Please be aware that orders that were previously fabricated on FR406 that specify a material requirement of “FR4” or “IPC-4101” (including Rev. C, Rev D, and Rev D-WAM1) slashsheets /98, /99, /101 or /126 may be fabricated on Isola 185HR laminate or Isola 370HR at our discretion. This would also apply to orders with the same IPC-4101 references but calling for /21, /24 or /26 with a fabrication document/print revision date of 12/31/2016 or prior. Orders calling for slash sheets /21, /24 or /26 with fabrication document/print revision dates after 12/31/2016 will require a deviation allowing the use of 185HR, 370HR or another alternative to FR406.

-

USTEK teams up with THOMASNET.com

Leave a CommentMaking a hard sell easier

You cannot sell water in the desert unless the local prospectors know that you have it and where to find you.

That was the situation at USTEK Inc. where our business of supplying made-to-print electronic and metal components was growing at an unsatisfactorily slow rate. We needed a way to get our story out to more potential specifying engineers and buyers.

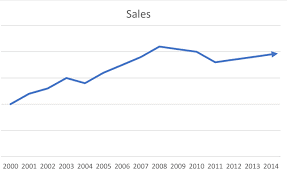

Since founding the company in 1987 we had grown in size and diversity, selling throughout North America, into the Caribbean region, and even exporting to China. The economic crash of 2008/9 had hit us hard and we needed a new approach. We began to seek a marketing strategy that would kick-start interest in our custom-making capability and get us back on a pattern of growth.

We had tried the usual on-line search engines, public speaking engagements, commission sales reps, cold-calling and authoring technical articles. Each of these took a great deal of staff time and added only a bit to the bottom line. None of them kicked us into high gear.

Then our operations manager Amy Holbrook thought to revisit the venerable encyclopedia of industrial products and services, the Thomas Register. We knew it and had used it years before but its most recent incarnation, tailored for the information age, had since been named THOMASNET.com.

At first not everyone at USTEK was on-board with this idea. Could a 120 year old company make such a dramatic change from paper publishing information on 650,000 companies to a user-friendly on-line searchable tool? A source that would cut buyer’s and specifier’s time from days to mere seconds? And would a company like ours fit into their scheme? Some of us thought this to be an unlikely pipe dream.

What convinced all of us to get onboard was the obvious organization, inventiveness, enthusiasm, and personal dedication of the THOMASNET.com team. From the very start they took the time to learn about our business, to measure the effectiveness of our current efforts, and to extract from us exactly the direction in which we wanted to grow.

They put together a layered plan that included features that THOMASNET.com would produce and items that USTEK would need to develop internally. It was a true team effort.

Did the new plan work?

We started to see immediate results with requests for quotation arriving weekly. Within six months we landed a new customer, that had found us through THOMASNET.com, whose business profit paid for the entire annual program cost. A 100% return on investment in less than a half-year.

THOMASNET.com coordinated the initial effort and then stayed with the program, month after month, to ensure that it met and indeed exceeded our expectations. Now two and a half years later they still keep close tabs on our program. They have helped us expand and fine-tune the program and are always available for us to bounce off them some new marketing ideas that we might have. THOMASNET.com has been a very wise investment decision.

The THOMASNET.com view of the relationship is on-line at their site: http://business.thomasnet.com/testimonials/ustek-a-thomasnet.com-case-study .

-

Effects of Shipment Terms and Conditions

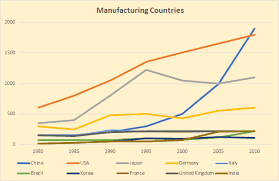

Leave a Comment Like it or not we must import from offshore so shipment terms and conditions are increasingly important. Regardless of the economic and the political climate, within the bounds of our 50 states we cannot locally source all our finished goods or even our raw materials. The US has been overtaken by China as the world’s leading manufacturing powerhouse, Japan and Germany are coming back, and India is starting to gain traction. That means that before placing an order we need to understand and calculate the final cost.

Like it or not we must import from offshore so shipment terms and conditions are increasingly important. Regardless of the economic and the political climate, within the bounds of our 50 states we cannot locally source all our finished goods or even our raw materials. The US has been overtaken by China as the world’s leading manufacturing powerhouse, Japan and Germany are coming back, and India is starting to gain traction. That means that before placing an order we need to understand and calculate the final cost.Avocados will be shipped to the Midwest from California, Mexico, Chile and elsewhere. Aluminum ingots will come from China, Russia, and Canada. Some televisions are made in the US by foreign companies but the majority are imported from Malaysia, Korea, Japan, India and China. Clothing could come from New England or from New Delhi. Even for electronics manufactured within the US the basic components have not been made domestically for decades, things like resistors, capacitors, and even ICs. All these are imported by air, sea, rail, and truck. But at what cost and under what conditions?

When an engineer specifies a component or a chef an ingredient there is always a cost/benefit tradeoff. Need a transformer quickly to meet a production deadline? What will the expedited shipment cost? Want the freshest fish for a restaurant? What will be its landed cost and will your patrons pay for the quality?

Your RFQ (request for quotation) sent to suppliers will be completed by the vendor’s sales staff and include their boilerplate terms and conditions – sometimes extending for several pages. You then respond with a purchase order that includes your boilerplate terms and conditions. If the two sets of conditions do not match then you will be set up for a war of the terms, something neither party desires. Yet differing terms could be the difference between a good price and an unacceptable price.

Sometimes the terms must change after the PO is issued; if a job becomes HOT! then the buyer might ask for expedited delivery and the seller might agree but often the final cost cannot be calculated until the last minute. Again – who will accept responsibility for the additional costs? It all depends.

In this case if the original terms are ex-works then all the shipping and handling are borne by the buyer, so any changes or expediting charges flow right back to the buyer. After that it gets complicated. The term FOB in the US is often taken to mean “delivered” whether it be delivered to the shipping dock or the receiving air/sea port or the buyer’s factory loading dock. What charges are included in “FOB” and who pays for them?

Fortunately there is international agreement on what all the shipping terms mean. Unfortunately some American companies have lost track of the differences. Perhaps it is time for a remedial course in Incoterms Rules. There are only 11 common terms: Ex Works, Free Carrier, Carriage Paid To, Carriage and Insurance Paid To, Delivered At Terminal, Delivered At Place, Delivered Duty Paid, Free Alongside Ship, Free On Board, Cost and Freight, and Cost Insurance and Freight.

Fortunately there is international agreement on what all the shipping terms mean. Unfortunately some American companies have lost track of the differences. Perhaps it is time for a remedial course in Incoterms Rules. There are only 11 common terms: Ex Works, Free Carrier, Carriage Paid To, Carriage and Insurance Paid To, Delivered At Terminal, Delivered At Place, Delivered Duty Paid, Free Alongside Ship, Free On Board, Cost and Freight, and Cost Insurance and Freight.These differing terms greatly change the cost to ship and the responsibility for coverage in the event of loss during transit. Following the link below you will see short descriptions of the 11 rules from the Incoterms® 2010 edition. ICC Terms Defined These should be read in the context of the full official text of the rules which can be obtained from the ICC BusinessBookstore.

And another listing is by the United Nations Economic Commission for Europe: INCO terms defined.The New Year is here – let’s get with the program and control our shipping costs! USTEK Inc. is not a freight expeditor but we are here ready to assist you in selecting the best shipment option. Call us at 614-538-8000 or e-mail us info@ustek.com with subject “Terms & Conditions”.

-

As copper goes so go PCB prices

Leave a CommentWhere has the price of copper been, where is it going, and how does it affect us in the electronics industry?

From the 1990’s to 2004 copper traded in a window of $1 per pound +/- $0.35. During this same period the price of oil tripled from $20 per barrel to $60 per barrel. US production workers’ salaries increased less than 5% (adjusted) while workers in Asia experienced a doubling in their salaries. The combination of these mixed directions, together with increased manufacturing efficiencies, held semi-finished and finished goods prices in check.

In the 2004 to 2009 period as copper prices began to increase the cost for energy increased as well; a barrel of oil doubled in price. Since then commodity copper trading has experienced ups and downs and during the past five years there has been an obvious overall downward trend as seen in this graph.

Downward trend that is until this year when prices have started an aggressive upward climb. This World Bank chart forecasts the increase in $/m-ton will continue for the next ten years. As with any forecast, world politics and the state of the international market will play a major role so the economic conditions in the major supplier countries is critical. Today the major producers of copper ore as ranked by output are Chile, China, Peru, United States, Australia, Russia, Canada, and then a host of smaller sources.

Comparing geographical regions by continent the ranking is South America, North America, Asia, Africa, and Europe. The Americas in total produce approximately half of the world output of copper. Although this might give some security in terms of supply during a world crisis it offers no protection against escalating prices on the world market. I.E. dollars held by China will buy copper as readily as dollars held by customers in the US. When the bidding starts the rule of supply and demand will prevail.

We already are seeing signs of price increases on printed circuit board copper laminate. Every half ounce additional in starting thickness adds up. So does heavier plate to give greater barrel thickness. If you spec 1 oz inner layers when half-ounce would do the job, that extra copper will cost more and more as the months progress.

An example of the price increases to date in 2016 for a standard raw material substrate, 2-layer 0.5oz FR4, is given in this graph:

But what does that mean to the designer who writes a specification using a common boilerplate description of copper weights? Below is an actual 4-layer board that was priced using several finished copper weights. As the cost of copper increases the price disparity of these designs will increase.

Time is money and so is copper. Keep this in mind as you spend extra time in your circuit board design and as you plan production pricing for the next few years. If the recent and forecast cost increases are valid then an upward price adjustment of 7% for 2017 and at least 5% for each year thereafter would be a prudent anticipation.

To offset this raw material cost increase you might take a close look at your entire board specification, seeking savings in reduced copper thickness, lower Tg, HAL vs ENIG, and substrate thickness. USTEK Inc. is here to partner with you in your effort to control costs and maintain your profitability. Contact info@USTEK.com.

-

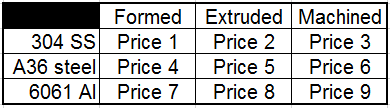

Oh my – Metal too?

Leave a CommentEven people who have been our PCB customers for 25 years can be surprised to learn that we are equally involved in custom metal components.

For our metals customers we provide the same personal service, design assistance, and stocking for JIT that you have experienced in our support for your PCB requirements. This attention to the complete customer’s needs defines who we as a company are.

Wherever you are in the project cycle your USTEK team will be there to support you. In some cases the design is already set in stone and the buyer is saddled with the tough job of finding the best combination of quality, delivery, and price. With the USTEK global network of partners we match your needs to the best possible manufacturing site.

A single manufacturing company is never the best choice for all your various needs but by using the 25+ years of experience USTEK you could be assured that we will do the grunt work and get the best fit to your needs.

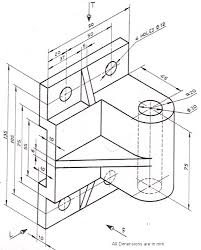

If your design is still in a state of flux, we could help there too. Have a design already sketched out but want options to choose the best process to manufacture? USTEK does that research every week.

If your design is still in a state of flux, we could help there too. Have a design already sketched out but want options to choose the best process to manufacture? USTEK does that research every week. We recently received a print to quote with the suggestion that it be extruded. After evaluating the part for manufacturability we suggested a sheet-formed piece that would have the same strengths, a better appearance, and a lower price.

Even further upstream the designer might wonder about the proper alloy to choose based on strength properties, resistance to environmental degradation, or strength-to-weight ratio. Our diverse background in this area could save the engineer weeks of searching and comparing options. We’ll do the grunt work and let you engineers do the creative work.

And if metals are just not the perfect fit for the application, rely on USTEK’s background of over 40 years in polymer development and marketing – but plastics are another story for another time.

Whether your metal parts are simple and weigh grams or complex and weigh 100’s of pounds, we are equipped and ready to serve you.

Please e-mail or call us when the time is right: r.simon@ustek.com or call 614-538-8000.